We are Here for You

As we navigate the uncertain environment created by the ongoing coronavirus pandemic, HBE continues to take measures to protect the health and safety of our employees, our clients, and the communities we serve. This includes efforts to ensure that we reduce the risk of spreading the virus in our workplace while also maintaining communication with our clients in an efficient manner.

We recognize the upheaval and uncertainty that you may be experiencing due to the effect of the coronavirus crisis locally, nationally, and globally. Our team is available and ready to help you and your business navigate these tough times. Please do not hesitate to contact us if you have any questions or concerns.

We will continue to provide updates on our response to the COVID-19 pandemic as they become available, or as adjustments become necessary to comply with public health guidelines.

Recovering & Rebuilding

We understand that your business may never be “back to normal.” We are here to help you prepare for a “new normal” and what that may look like for you, your business, and/or your employees. Now more than ever, it’s important to take a look at what’s working and what’s not. Let HBE help you!

- Data Analytics

- Business Valuation

- Business Transition, Succession, and Wealth Transfer Consulting

- Budeting, Forecasts, Projections, and Cash Flow Analysis

- Interim Controller, CFO, and Client Accouting Services

- Fraud Examinations

- ERP Software Support

- Consulting on Changes in Organizational Structure/Entity Selection

- Job Costing and Overhead Analysis

- Strategic Planning

- Benchmarking and Analytic Review

Announcements

Paycheck Protection Program (PPP) Loan FAQs

August 19, 2020 – What We Know: Presidential Order to Delay Payroll Tax

June 16, 2020 – PPP Loan Forgiveness Clarification for 60% Payroll Cost Requirement

June 5, 2020 – Congress Passes PPP Flexibility Act of 2020

May 29, 2020 – House Passes Bill to Provide PPP Forgiveness Flexibility

May 21, 2020 – USDA Provides Details of Coronavirus Food Assistance Program

May 20, 2020 – SBA Provides Loan Forgiveness Application and Instructions

May 13, 2020 – Update on PPP Good Faith Certifications

May 12, 2020 – Next Steps for Approved EIDL Applicants

May 11, 2020 – Updates and New Guidance on SBA Disaster Relief

May 5, 2020 – Ag Businesses Now Eligible for Economic Injury Disaster Loans & Grants

April 30, 2020 – SBA Clarification on PPP Qualifications

April 24, 2020 – Additional Funding for Federal COVID-19 Loan Programs

April 20, 2020 – Best Practices for Nonprofits Receiving COVID-19 Relief Funding

April 16, 2020 – Reminder of 2020 Tax Filing Due Dates

April 16, 2020 – SBA Communicates New Guidance on EIDL Advance

April 2, 2020 – Paycheck Protection Program (PPP)

March 30, 2020 – 2020 Cares Act | What it Means for Business & Individual Income Tax

March 25, 2020 – Webinar Recording | Coronavirus, Taxes, and the Workplace

March 19, 2020 – Federal Aid Package Helps Individuals Affected by COVID-19

Webinar Resources

COVID-19 Tax Reform, Response, and Updates on Disaster Relief

PPP Loan Forgiveness & EIDL Updates

May 20, 2020

COVID-19 Relief Provisions

April 3, 2020

Nonprofit Presentation

General Business Presentation

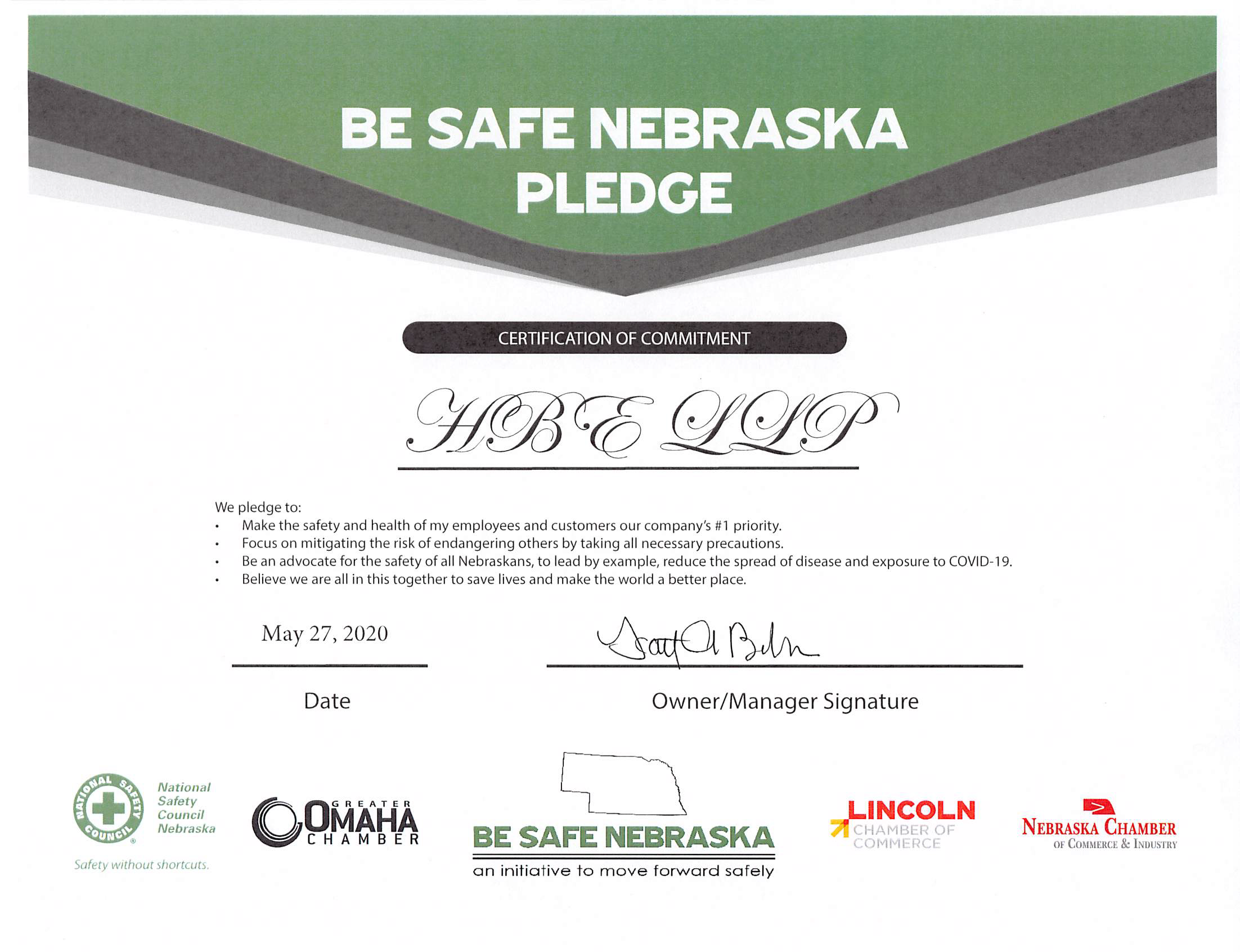

We Pledge – Be Safe Nebraska

We pledge to be committed to the safety of all Nebraskans.

-

We pledge to make the safety and health of my employees and customers our company’s #1 priority.

-

We pledge to focus on mitigating the risk of endangering others by taking

all necessary precautions.

-

We pledge to be an advocate for the safety of all Nebraskans, to lead by example, and reduce the spread of COVID-19.

-

We pledge because I believe we are all in this together to save lives and make the world a safer place.